Bitcoin Price Prediction 2025-2040: Navigating Volatility for Long-Term Gains

#BTC

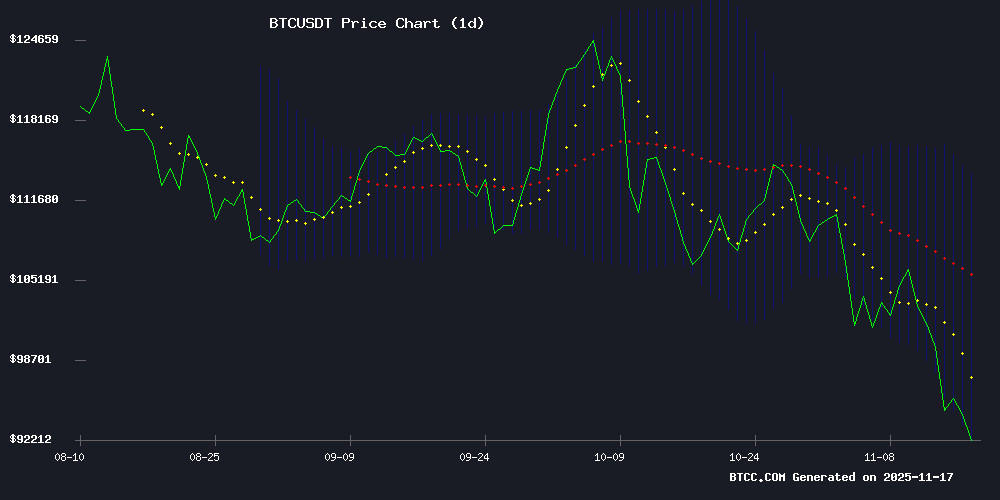

- Technical Bottom Formation: BTC tests Bollinger support at $92.5K with oversold MACD conditions

- Institutional Dichotomy: Short-term ETF outflows contrast with sovereign wealth adoption

- 2040 Vision: Bitcoin's fixed supply could drive exponential gains post-2030 halving cycles

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish, Long-Term Bullish Signals Emerge

BTCC financial analyst Ava notes BTC currently trades at $94,106 (17-Nov-2025), significantly below its 20-day MA ($103,062). The MACD histogram (1,668) shows weakening bullish momentum, while price sits NEAR Bollinger Lower Band ($92,542) - typically a buy zone.Ava observes.

Mixed Sentiment as Institutional Players Reshape Bitcoin Landscape

Despite $1.11B ETF outflows and Coinbase's structural changes, Ava highlights bullish catalysts:The stablecoin liquidity uptrend () historically precedes BTC rallies.she adds.

Factors Influencing BTC’s Price

Institutional Investors Unfazed by Bitcoin Core vs. Knots Debate

Institutional Bitcoin investors remain largely indifferent to the ongoing technical debate between Bitcoin Core and Knots, according to Galaxy Digital's head of research, Alex Thorn. The dispute centers on whether non-financial transactions should be exempt from regulation, a discussion reignited by Bitcoin Core's recent v30 update. Critics argue the update could enable blockchain "spam," while proponents warn that filtering such activity risks fragmenting the network and undermining Bitcoin's foundational principles.

Historical precedents like the block-size wars and SegWit adoption suggest such debates rarely disrupt long-term adoption. A Galaxy Digital poll of 25 institutional investors revealed 46% were unaware of the conflict, while 36% viewed it as inconsequential. The market's muted reaction underscores institutional focus on Bitcoin's macroeconomic role rather than protocol-level technicalities.

US Spot Bitcoin ETFs See $1.11B Outflows Amid Sustained Selling Pressure

US spot bitcoin ETFs bled $1.11 billion in net outflows from November 10-14, marking a third consecutive week of withdrawals. BlackRock's IBIT led the exodus with $532 million in outflows, while Grayscale's BTC fund shed $290 million. Total ETF assets now stand at $125.34 billion, representing 6.67% of Bitcoin's market capitalization.

Metaplanet CEO Simon Gerovich downplayed competitive concerns, noting ETFs provide "static exposure" that doesn't expand without fresh inflows. The Japanese Bitcoin treasury firm maintains its strategic advantage in active BTC accumulation, contrasting with ETFs' passive structures.

How Low Can The Bitcoin Price Go Before The Bleed Ends?

Bitcoin's price trajectory has turned bearish after failing to hold above $100,000 for the second time this month. The cryptocurrency's slow, grinding decline reflects a market dominated by sellers, with liquidity hunts exacerbating downward pressure. Analyst TehThomas notes that reclaiming $97,000 is critical for any short-term recovery—a level that WOULD signal renewed buyer interest and potentially propel BTC back above six figures.

Whale sell-offs have been a primary driver of the downturn, erasing gains from Bitcoin's recent all-time high of $126,000. The absence of bullish momentum leaves the market vulnerable to further downside unless key resistance levels are decisively breached. For now, traders watch for either capitulation or a structural shift in demand.

Bitcoin's Market Cap Holds Strong Amid Short-Term Volatility

Bitcoin's recent drop to $96,000 has rattled markets, with the Federal Reserve's potential pause on rate cuts strengthening the dollar and pressuring alternative assets. Yet analysts argue the cryptocurrency's long-term value proposition remains intact.

Hunter Horsley of Modern Diplomacy highlights Bitcoin's $1.9 trillion market cap as merely scratching the surface of global asset pools. Equities hold $120 trillion, fixed income $140 trillion, real estate $250 trillion, and Gold $30 trillion. "Zoom out," Horsley advises, noting Bitcoin's microscopic share of these markets leaves exponential room for growth.

The Fed's 52% probability of maintaining rates has created headwinds, but Bitcoin's fundamentals endure. As traditional markets wobble, the cryptocurrency's finite supply and decentralized nature continue attracting institutional interest. This isn't about $94K or $105K - it's about Bitcoin claiming its share of the $500 trillion global asset pie.

Stablecoin Liquidity Uptrend Hints at Bitcoin Price Recovery

Bitcoin's price action remains sluggish in early November, hovering NEAR the $95,000 support level after losing its $100,000 foothold. Despite the lack of bullish momentum, on-chain data reveals a promising trend: stablecoin exchange reserves are rapidly increasing.

Historical patterns suggest this accumulation often precedes significant price rallies. In July 2025, a similar surge in stablecoin liquidity preceded Bitcoin's breakout above $110,000. The same dynamic played out in August-September, with $8 billion in stablecoin inflows foreshadowing a late-September price surge.

Analysts from XWIN Research Japan note the current stablecoin buildup mirrors these past catalysts. Market watchers now eye December as a potential inflection point for BTC's next leg up.

Coinbase Triggers Structural Shift in Crypto Capital Formation, Bitwise CIO Says

Bitwise Chief Investment Officer Matt Hougan declares a pivotal moment for cryptocurrency markets, with Coinbase at the center of what he describes as a fourth major financial disruption. The emergence of institutional-grade initial coin offerings could redefine capital markets by 2026.

Hougan's thesis positions Bitcoin as the new gold, stablecoins as the future of dollar transactions, and tokenization as the backbone of trading infrastructure. "Most assets will eventually migrate to blockchain rails," he predicts, drawing parallels to gold's centuries-long adoption curve.

The traditional IPO system faces obsolescence, according to the memo. Venture capital's gatekeeper role in funding startups may dissolve as tokenized fundraising gives retail investors unprecedented early access—a market currently dominated by institutional players.

Luxembourg Sovereign Wealth Fund Exclusively Backs Bitcoin in Landmark Move

Luxembourg has made a decisive bet on Bitcoin as the sole cryptocurrency allocation for its Intergenerational Sovereign Wealth Fund (FSIL), dismissing diversification into other digital assets. Finance Minister Gilles Roth announced the €7 million investment—representing 1% of the fund’s assets—at Bitcoin Amsterdam 2025, framing it as a strategic embrace of "secure, open, and competitive" financial innovation.

"There is no second best," Roth declared, invoking MicroStrategy CEO Michael Saylor’s bullish Bitcoin maxim. The audience erupted in applause as he affirmed Luxembourg’s long-term commitment with a meme-ready pledge: "Let me be clear—Luxembourg HODLs." The MOVE positions the nation as Europe’s first sovereign investor to directly allocate treasury reserves to Bitcoin.

Cash App Integrates Lightning Network for Direct Dollar-to-BTC Payments

Cash App has rolled out a new feature enabling users to send dollar payments via the Lightning Network, which are automatically converted to Bitcoin (BTC) and delivered to the recipient's wallet. This eliminates the need for users to hold BTC beforehand, streamlining peer-to-peer transactions on Bitcoin's layer-2 scaling solution.

The feature, teased on social media before its official announcement, marks a significant step toward mainstream adoption of Lightning Network rails. Cash App had previously introduced Lightning addresses in 2022, but this update focuses on preserving BTC holdings while facilitating instant dollar-to-crypto transfers.

Merchants can now receive BTC directly from Cash App balances via Lightning, while U.S. customers gain a frictionless way to transact without intermediary exchanges. The move follows Square's recent expansion of BTC payment options, signaling growing institutional embrace of Bitcoin's payment potential.

Bitcoin Recovers Above $104K Amid Market Volatility, Analysts Urge Caution

Bitcoin staged a sharp recovery after briefly dipping below $100,000, climbing back above $104,000 amid volatile trading conditions. While the rebound has injected Optimism into crypto markets, analysts warn the asset isn't out of danger yet—technical indicators like the Volume Weighted Average Price and 50-week moving average remain critical watchpoints.

The market's recalibration phase presents strategic opportunities for investors to identify high-potential assets. Focus has shifted toward projects with substantive fundamentals rather than fleeting trends, particularly those demonstrating strong presale activity.

Bitcoin's price action saw a rapid 5% swing from $99,250 lows, underscoring persistent instability. Traders await the weekly close for confirmation of either a sustained recovery or further downside risk to the bull cycle.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

BTCC's Ava provides this projection framework:

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $85K | $110K | $140K | ETF inflows, halving aftermath |

| 2030 | $250K | $400K | $600K | Institutional adoption, scarcity premium |

| 2035 | $800K | $1.2M | $2M | Global reserve asset status |

| 2040 | $1.5M | $3M | $5M+ | Network effect dominance |

Note: Predictions assume successful Layer 2 scaling and regulatory clarity. 2025 volatility reflects current technical retracement.